A collection of data and process knowledge to enable collaboration inside projects, handling finances, forms and involvements for the Edgeryders social enterprise registered in Estonia.

Content

- 2.1. Primary bank account (BNP Paribas)

- 2.2. Secondary bank account (Wise)

- 2.3. Legacy bank account (LHV)

- 3.1. Accounting for revenue and expenses

- 3.2. Checking FreeAgent data for consistency

- 3.3. Creating and managing a budget

- 3.4. Making a payment

- 3.5. Invoicing a client

- 3.6. Invoicing Edgeryders and getting paid

- 3.7. Reimbursing expenses

- 3.8. In-kind benefits

- 3.9. VAT tax returns

- 3.10. Approving and filing the annual report

- 3.11. Monitoring the company’s cashflow

- 3.12. Obtaining audited accounts

- 3.13. Contacting our accountants

- 3.14. Monitoring fixed costs

- 3.15. Starting a project in FreeAgent

- 3.16. Managing FreeAgent contacts

- 3.17. Purchasing physical products for Edgeryders

- 3.18. Filing annual accounts with the Estonian revenue agency

- 3.19. Verifying that a payment was made

- 3.20. Recording payments out of the BNP Paribas Warsaw bank account

- 3.21. Accounting manual: bookkeeping cheatsheet for Edgeryders

- 4.1. Signing

- 4.2. Estonian Statistical Service “E-Stat”

- 4.3. Participating in EU funded research

- 4.4. Managing an Edgeryders project

- 4.5. Accessing Edgeryders accounts on third-party platforms

- 4.6. Producing an Edgeryders report

- 4.7. Joining the Edgeryders management board

- 4.8. Using edgeryders.eu e-mail addresses

- 4.9. Setting up an Estonian Osaühing (OÜ) company using E-ID

- 4.10. Setting up an Estonian one-person company using E-ID

- 4.11. Data protection compliance

- 4.12. Onboarding a collaborator

- 4.13. Adding a management board member

- 4.14 Authorizing third parties to submit tax filings on behalf of Edgeryders

- 4.15. Creating and documenting a process

1. Company information

Some salient documents are available here on our platform, without accessing the Estonian e-Business Register. All dates in the table below are in the yyyy-mm-dd international date format.

| Company name | Edgeryders OÜ | The official business name as listed by the registry includes "OÜ" (capital-O, capital-U-umlaut). It's the abbreviation for "Osaühing", the private limited company in Estonian law. It's always abbreviated in company names though. |

|---|---|---|

| Company number | 14213857 | Called "Registry code" by Estonian officialdom. Proof: e-Business Register record. |

| Place of registration | Estonia | Do not use the office address, reference to the company register or other for a "place of registration" field. |

| Company type | private limited company | More precisely an Estonian "Osaühing", the private limited company in Estonian law. Proof: e-Business Register record, where it says: "Legal form is osaühing [private limited company] (sic)". |

| Share capital | 2500 EUR | Proof: e-Business Register record. |

| Registration authority | Tartu County Court | Proof: e-Business Register record, which says in the title: "Commercial register card No . 1 has been opened in Tartu County Court Registration Department". |

| Date of incorporation | 2017-03-01 | Proof: e-Business Register record, which says: "Entry 1: Approved on 01.03.2017 (first entry)". |

| Management board | Alberto Cottica John Mc Kenzie Coate Fatima-Nadia El-Imam Matthias Ansorg Hugi Ásgeirsson |

Required when a form asks for "directors", "executive officers" or similar. Spelling is exactly as on the Estonian E-ID cards, and as entered into the Estonian business register. Proof: e-Business Register record. |

| Contact person | e-Advisors OÜ | Since 2018, the Estonian commercial code disposes that companies whose directors are non-residents must maintain a contact person within Estonia. See this post. Proof: company data page in the company registration portal |

| Official e-mail address | 14213857@eesti.ee edgeryders.oy@eesti.ee |

This "official e-mail address in Estonia" of the company is "designed for interactions with the Estonian state". Current redirections are: matthias@edgeryders.eu. Proof: page in the e-Business Register, after clicking "Alter" there. |

| Non-profit status | yes | While Estonian private limited companies are typically for profit, the Articles of Association (AoA) of Edgeryders OÜ make it a not-for-profit. Proof: Edgeryders OÜ Articles of Association. This is a public document that can be downloaded for free from our page at the Estonian e-Business Register. NB: the binding version of the AoA is the one in Estonian. And the download only includes the Estonian version. We do not have an official translation available. |

| Registered address |

Pärnu mnt, 139e/2-8 11317 Tallinn Estonia |

Last update of registered address done 2023-09-07. This address is identical to that of the registered business address of e-Accounting Estonia OÜ, our accountants. Spelling exactly as in the e-Business Register record is "Harju maakond, Tallinn, Kesklinna linnaosa, Pärnu mnt 139e/2-8, 11317". Maakond is normally translated as "county", linnaosa as "(city) district" and mnt abbreviates maantee, "road". Finally, Kesklinna means "central town". So we are in Pärnu road, Harju county, Kesklinna city district. Also named "registered office [address]", "[address of] head office" in forms. This is not a "business address". It is for legal, reporting and governmental usage only. – Compare "Use of the registered address" below. Proof: e-Business Register record. |

| Tax ID | 14213857 | Also called TIN (tax identification number). Used for national taxation purposes, so only inside Estonia. In Estonia, the tax ID is identical with the company's so-called "registry code" (source). Proof: e-Business Register record. |

| VAT ID | EE101972833 | The company's VAT identification number, using the scheme of the European Union. Needed to take part in international trade. As of 2017-05-19. |

| Financial year | Jan 1 to Dec 31 | Same as the calendar year. Proof: e-Business Register record. |

| E-mail address | contact@edgeryders.eu | Our de-facto default e-mail address. It has no official / registered character though. |

| Phone | +32 2 5881268 | Currently we can use this (landline number of Alberto and Nadia in Brussels) where we have to give a company phone number in a form. |

| Fax | n/a | If we need fax, we can however get us a number from a fax-to-email provider. @matthias recommends Sipgate. |

| CI design | See this topic. |

Requirements for legal and taxation compliance. For the Edgeryders OÜ company, the authoritative information sources about taxation and legals in Estonia are:

- eesti.ee. The government portal. Especially relevant: eesti.ee/eng/topics/business.

- emta.ee. The Tax and Customs Board.

2. Banking information

We currently use two bank accounts, as documented below.

2.1. Primary bank account (BNP Paribas)

This bank account with BNP Paribas in Warsaw is our main bank account now. Use it for all the company’s banking needs. Except for payments to collaborators and general card spending, which we do via our Wise Business account.

-

Account holder: Edgeryders OÜ

-

Bank name: BNP Paribas Bank Polska

-

Branch address: ul. Kasprowicza 119A, Warsaw

-

IBAN: (A Polish IBAN has 28 digits, the letters “PL” followed by 24 numbers.)

- EUR sub-account: PL26 1600 1462 1829 8680 8000 0002

- USD sub-account: PL96 1600 1462 1829 8680 8000 0003

- PLN sub-account: PL53 1600 1462 1829 8680 8000 0001

We assume that any currency gets automatically re-routed to the right sub-account. So, if you would send USD to PL26 1600 1462 1829 8680 8000 0002 it would arrive on the USD sub-account PL96 1600 1462 1829 8680 8000 0003. However, we have yet to confirm this, so better hand out the IBAN suited to the currency to be received.

-

SWIFT/BIC: PPABPLPK

-

Bank account users: @nadia is the only registered user of the account.

-

Online banking login. We use BNP Paribas’s online banking. It is cost-free to use. To log in, you need access to Nadia’s mobile phone.

-

Document of proof: To prove the bank account in a form, normally a recent bank statement will do which you can obtain via CFO. Else there is the confirmation letter for the account opening.

2.2. Secondary bank account (Wise)

This bank account is a Wise Business account. We use it to process payments to suppliers in a more distributed way, as it allows proper multi-user access. Wise is not a traditional bank as they do not provide access to credit, but they do provide accounts with a proper IBAN number.

-

Account holder: Edgeryders OÜ

-

Bank name: Wise Europe SA

-

Bank address: Wise Europe SA, Rue du Trône 100, 3rd floor, Brussels 1050, Belgium

-

IBAN:

- EUR account: BE87 9677 2740 6194

- USD and other accounts: not available yet, but can be immediately created in the wise.com online banking interface, without additional costs

-

SWIFT/BIC: TRWIBEB1XXX

-

Bank transfers to our Wise account. Starting from 2023-08-31, both method to add funds by bank transfer to the Wise account work without issues (confirmed by @matthias with tests):

-

You can send send funds by bank transfer, using Edgeryders’ EUR account details at Wise as shown above (account holder “Edgeryders OÜ”, IBAN BE87 9677 2740 6194). This is the preferred method, as it allows to enter a custom reference text that will be visible in the Wise online banking interface. Plus, it allows to save the account as a template.

-

Alternatively, you can use the process in the Wise online banking interface to add funds to the balance (Home → choose EUR balance → Add), which will direct you to send to the catch-all generic Wise account together with a specific reference text.

Both processes work well even when sending from an account that does not belong to Edgeryders OÜ (but that latter fact is specific to Wise business accounts, as personal Wise accounts may only receive money from the person it belongs to).

-

-

Bank transfers from our Wise account. Transfers from the Wise EUR balance to other bank accounts are executed as realtime transfers, arriving immediately to the other bank account, even outside banking hours. When sending money from the EUR balance on Edgeryders’ Wise account to a different bank account, then the recipient will see the following details on the incoming bank transfer: “originator: Edgeryders OÜ” and “IBAN: IBAN BE87 9677 2740 6194” (Edgeryders’ own IBAN at Wise). This is good, as it appears like any regular bank transfer, in Edgeryders’ name, and means we can use the Wise account just like a regular bank account.

-

Debit cards: Every user of the Wise account with full access (“Admin” team role) can order their own digital or physical debit card (VISA or Mastercard) in the Wise online banking interface, for free. Other users (“Employee” team role) can also get their own debit card, but it has pre-set limits managed by admin users. Our policy is that every user should get and use their own debit card. This is more resilient in case of card loss, card freezing, or the current or future use of 2FA for card payments. Such as the “Verified by VISA” process, which sends SMS to a connected phone number. Currently, the following users have Wise debit cards: @matthias.

-

Bank account users: @matthias, @nadia and @ivan have full access to the bank account. @matthias is the “Owner” user at the moment, but that simply means it is the only user that cannot be deleted.

-

Online banking login. Use https://wise.com/. To log in, you need your personal set of Wise credentials, which also give access to your personal Wise account (if you have one). The login requires 2FA, typically via text message to your phone.

-

Document of proof: To prove the bank account to a third party, generate a document of proof in the Wise online banking interface under “Manage → Your account details → Euro → Get proof of account details”.

2.3. Legacy bank account (LHV)

Our bank account with LHV Pank [sic!] in Tallinn has been our main bank account for years until LHV unilaterally cancelled the relationship for bogus reasons (“company not tied to Estonia” … hellooo, the Estonian E-Residency scheme is made for companies not tied to Estonia?).

Use only where necessary for legacy reasons. Also, it could never be used for incoming payments in USD currency. This is because some of our clients insist on paying in USD only but LHV does not have a U.S. American correspondent bank, so wire transfers from the U.S. into our account bounce back. When making outgoing payments in USD, we can use Wise, which is integrated with our LHV account.

-

Account holder: Edgeryders OÜ

-

Bank name: LHV

-

Branch address: Tartu mnt 2, Tallinn, Estonia.

-

IBAN: EE12 7700 7710 0255 0175

(An Estonian IBAN has 20 digits, the letters “EE” followed by 18 numbers.) -

BIC: LHVBEE22

-

Bank account users: @noemi and @alberto are so far the only registered user of the account. To add more users, as of 2018-10 LHV Bank still requires a visit of the new user to their offices in Estonia.

-

Document of proof: To prove the bank account in a form, normally a recent bank statement will do which you can obtain via CFO. Else there is the confirmation letter for the account opening.

3. Financial processes

State of completion. By now, all relevant financial processes from the equivalent document for Edgeryders LbG (“Managing the finances of Edgeryders LbG”) have been taken over into this one and adapted as needed. So, no need to look into any legacy document anymore! ![]()

3.1. Accounting for revenue and expenses

Accounting system

We use FreeAgent (as stand-alone software, not tied to any accountant organization) as our accounting software:

- base URL: https://edgeryders.freeagent.com/

- login URL: Log in to your FreeAgent account

Reconciling bank statements

Bank transaction data are the main input into FreeAgent, but there is no direct feed from our bank account to LHV. We add them semi-automatically, through the following process. Note: logging into LHV’s online banking requires that your e-ID card corresponds to an authorized user bank account user. You will also need the software used by your browser to communicate with the Estonian e-ID services, downloadable here: Install ID-software - ID.ee

-

Save the banking statement in CSV format in the LHV online banking interface.

-

Convert from CSV to FreeAgent format using our Python script

lhv-2-freeagent-converter. There are two versions of the script, use the one that fits your Python version. -

Upload the output file to FreeAgent by using “Upload statement” on the main dashboard or in the “Banking” menu of FreeAgent. Uncheck the “guess explanations” option.

-

Upload the output files for forex transactions to FreeAgent (if any). Our LHV bank account is multi-currency, which means that incoming payments in currencies other than EUR are not converted into EUR, but deposited in “virtual accounts” with the same IBAN as the main one, but denominated in the currency of the transaction. Our script

lhv-2-freeagent-converterdetects any non-EUR transaction and exports additional CSV files, one per each currency encountered. The files are always calledtransactions_in_[CURRENCY CODE].csv. These files must be uploaded onto FreeAgent, selecting the “virtual account” of the appropriate currency. If no such account exists, you should create it first.

-

Explain the banking transactions in FreeAgent. FreeAgent will list unexplained transactions and only be happy when that number is zero.

When explaining the transactions, take care to check the VAT setting resp. to make the right setting there, as that is our largest source of accounting mistakes. The VAT field is there to capture the amount of Estonian VAT only, because only that is VAT that we can claim via pre-tax deduction in our VAT tax return in Estonia. If an invoice by mistake contains non-Estonian VAT, it must not be entered into the VAT field but is simply “something we paid and cannot get back”. Due to this, the VAT to acount for is nearly always zero. In more detail, there are only these two rules:

-

Enter non-zero VAT for Estonian VAT for purchases of physical products from a business with an Estonian VAT number.

-

Never enter VAT for banking charges, even if our bank is itself Estonian. When reconciling banking charges, set VAT to 0%.

-

3.2. Checking FreeAgent data for consistency

When tidying up records for making a VAT return or yearly return, here are some ways to check for internal consistency, allowing to spot incomplete / erroneous data in FreeAgent:

-

“Balance Owed” is zero or positive for all users. A negative balance would indicate overpayment, or payment for expenses where the receipts have not yet been entered into FreeAgent.

-

Balance of the virtual conversion accounts is zero. Refers to the “Bill / Expense Payments (GBP)” and “Invoice Receipts (GBP)” accounts. For each payment into these accounts, there has to be a payment of the same amount on the same day out of these accounts, serving the purpose of converting the currency of accounting to allow us accounting for EUR payments in GBP within FreeAgent. So if the balance is non-zero, there is either a mistake, or these accounts have been misused.

3.3. Creating and managing a budget

The process for creating a project budget and monitoring it for overspending and cashflow issues during the project is documented in detail here:

3.4. Making a payment

We only use regular bank transfers, the company’s MasterCard credit card and occasionally Wise (formerly Transferwise) for making payments:

-

Bank transfers. See above for the LHV online banking login. The bank payment feature in there is well-designed and intuitive, so no need for specific documentation.

-

MasterCard. We have a MasterCard debit card / prepaid credit card, with online payment enabled (card number ending in

2016). It is in the office in Brussels, as is the PIN code. For normal business, its daily limit is set to 1,000 EUR; its monthly limit to 2,000 EUR. Limits can be changed using LHV’s online banking interface, and changes are effective immediately. -

Wise. LHV Bank is fully integrated with Wise. We have linked the company’s Wise account with our LHV bank account. Now, to make non-EUR payments, choose “TransferWise payment” from the “Payments” menu in LHV’s online banking, and fill in the required information. We still can use Wise to receive money.

-

Azimo. We used it for a time, but no longer recommend it. TransferWise is now the better alternative for all its use cases.

3.5. Invoicing a client

The process of invoicing Edgeryders’ clients for work performed is documented in detail here:

It also covers cases where clients pay us not based on an invoice but another document, like a grant agreement.

3.6. Invoicing Edgeryders and getting paid

The process for submitting your invoices and getting them paid by Edgeryders OÜ is documented in detail here:

3.7. Reimbursing expenses

The process for being reimbursed by Edgeryders OÜ for your expenses during projects is documented in detail here:

3.8. In-kind benefits

There are legal ways how a company can offer in-kind benefits to its employees and collaborators, which offers them tax advantages compared to getting more money. In Edgeryders OÜ, we offer this only to close, regular collaborators. In addition, this process is only possible for items that the beneficiary needs and uses for her work for Edgeryders OÜ, such a computer or phone. Otherwise the item cannot be justified as a business expense for the company but instead would count as implicit profit distribution, which would be taxable for the company and is something we can’t do anyway as a not-for-profit company.

The process step by step:

-

The company buys an item and pays for it.

-

The item is accounted for as an expense of an Edgeryders OÜ “Core” project in FreeAgent. (Because it is not tied to the execution of any particular client project.)

-

The item is also recorded as an asset of Edgeryders OÜ in the accounting system, with its purchase value.

-

The beneficiary issues a credit note document for the cost of the item to Edgeryders OÜ.

-

The credit note is recorded in FreeAgent as a “bill credit note” in the same “Core” project. It is basically booked as “an invoice with a negative amount”.

-

Edgeryders OÜ performs the recommended reconciliation procedure for netting the bill credit note against the bills already issued by the beneficiary.

-

Edgeryders OÜ pays the outstanding bills of the beneficiary, less the amount of the credit note.

-

Edgeryders OÜ deducts the cost of the item as business expense, distributed over the legally mandated depreciation time (e.g. 3 years for a computer). This decreases the value of the asset in the books until it hits zero.

-

If you have to include in-kind benefits in your tax statement in your jurisdiction, in addition follow these steps (adopted from recommendations for tax-free benefits to employees in Germany:

-

Sign a leasing contract with Edgeryders OÜ where you pay a low, nominal amount for being allowed to use the item. The leasing contract makes it explicit that getting to use the item is not a gift, so you don’t have to include it as an in-kind benefit in the tax statement.

-

If you use the item for your own business / solo entrepreneur company, book it as a business expense. (Not applicable if you also use the item privately and your jurisdiction mandates that such items cannot be registered as a business expense.)

-

At the end of the leasing period, you buy the item for its low remaining value that it has in the books of Edgeryders OÜ. (In some jurisdictions, there are even rules for this, for example “3% of new price” for a smartphone leased to an employee in Germany.)

-

This process keeps our project accounting in order, since project costs (and project costs only) are assigned to projects, with their full amounts. It is tax neutral for Edgeryders OÜ: it is not possible to deduct the full costs as a business expense in the first year, which increases the profit – but for an OÜ, profits are not taxed until distributed. It is a tax advantage for the beneficiary, since the use of the item is not taxed in their jurisdiction, unlike the equivalent in money.

3.9. VAT tax returns

VAT in Estonia is monthly. VAT returns are due on the 20th of the following month: the VAT return for February is due March 20th.

3.10. Approving and filing the annual report

The financial year of Edgeryders OÜ coincides with the calendar year. The annual report, relevant for corporation tax, is due by June 30th of the following year. So, accounts for financial year 2017 must be filed with the tax authority by June 30th, 2018.

According to Estonian company law, the management board is responsible for approving the annual report and submitting it to the Estonian tax authority. Legally one signature is enough, but we (the management board) have decided that all board members should digitally sign the annual report.

How it works in practice:

-

Accountant: Preparate the report. The accountant prepares the annual report based on FreeAgent data and a short report they will request us to write about the company’s operation in the year. (This is required by Estonian law to be included when filing the annual report.)

-

Upload the report. The accountant uploads the report onto the Company Registration Portal, then informs one of us by e-mail, who will invite all board members to sign the report, as shown below.

-

Board members: log in. As a board member, go to Registrite ja Infosüsteemide Keskus, then navigate there to “Company Registration Portal” and log in using your E-ID card (needs PIN1).

-

Find and view the report. Go to “Annual reports → Incomplete reports” and click “view” for the report about the last calendar year.

-

Download reports. This next screen contains some general information. Download the annual report’s PDF files, both in Estonian and in English. They are easy to find because they have PDF icons.

-

Check that the report is consistent with FreeAgent. FreeAgent is the authoritative record for our accounting – if anyone asks questions we need to be able to refer back to it. To check consistency, do this:

-

Log into FreeAgent.

-

In FreeAgent, click “Accounting → Reports”.

-

Examine the Balance sheet and Profit and Loss reports, checking that they are consistent with those in the annual report. The annual report contains the same information, just with slightly different names.

-

If they are not, inform the accountant and ask why: some further reconciliation might be necessary. Note, however, that the accountant might be presenting the report in a slightly different form than FreeAgent. For example, FreeAgent records depreciable assets at book value (acquisition value - depreciation), while many accountants prefer to record the assets at full acquisition value, and put the depreciation as a liability.

-

Important: Also check the English version against the Estonian one. The latter is, as always, the one with legal value.

-

-

Sign. Back in the Company Registration Portal, click “Add a digital signature to the report” and sign (needs PIN2).

-

Final signatory only: Add profit distribution information. After all board members signed, one has to go to the same online place where the signing happened and fill in the form about the distribution of profit or covering of loss. It is important (for us as a not-for-profit company) to not indicate any distribution of profit as that would subject it to taxation (see). Instructions (as derived from how our accountants did it for 2017):

-

Click the button “Continue to the next step” at the bottom.

-

Add the following two forms to the report: “Profit distribution proposal” and “Profit distribution decision”.

-

In both forms, fill in the field “Retained earnings after distribution (covering)” with the total amount of profit as noted at the top of the form.

-

In both forms, also fill in the “additional information” free-text field at the bottom with a note like this (in English only is fine):

According to the Articles of Association, Edgeryders OÜ is a not-for-profit company. This prohibits us from distributing our profits, so we retain them for future use in business activities according to the business purpose of the company.

-

-

Submit. As a final step, a management board member or the accountant should then submit the finished annual report by using the “Submit now …” button at the same screen where the profit distribution forms were added. Note that this must be done before or on June 30 for the annual report of the previous calendar year.

-

Download to archive. After submission, the submitted files will be available for download in the Company Registration Portal under “Annual Reports → Reports submitted”.

3.11. Monitoring the company’s cashflow

Our current process is a monthly call with all management board members and project managers to detect and prevent cash flow issues. These calls are coordinated by @nadia. For and in these, calls, we look at the following:

- the Magic Spreadsheet, our company-wide cashflow forecasting tool (hint

)

) - project status reports by project managers

- our accounting in FreeAgent

(If you want to use a copy of the Magic Spreadsheet in your own organization, get it from here.)

How to use the Magic Spreadsheet

This is our main tool to predict and monitor the company’s overall cash flow, to look at the size and health of our project pipeline, and to get an overview of the projects we’re doing. You can find it in Edgeryders’ Google Drive Enterprise space here (but it is only accessible by management board members):

Team Drives → Directors → Finances and Legals → Magic Spreadsheet for Edgeryders OÜ

The Magic Spreadsheet will generate an accurate cashflow prediction automatically, but only if project managers follow the process. So to detect and fix the most common errors with project budgets, you’d use the Magic Spreadsheet like this:

-

Enter the day’s bank balance in field

Projects!B1. (It’s possible to automate this with the FreeAgent API, but we didn’t so far.) In a perfect world, this should be the only thing you need to do before getting an accurate cashflow prediction in sheet “Cashflow”. -

Make sure all projects are listed. Starting with October 2018, all Edgeryders projects should be listed in the “Projects” sheet of the Magic Spreadsheet. This also includes also all internal projects (core and investment projects) in order to capture all costs for an accurate cashflow prediction. Only projects that were already “Finished” or “Dropped” in October 2018 are excluded, because they pre-date the Magic Spreadsheet. If a project is not listed, ask the project manager to create a budget spreadsheet for it.

-

Make sure all active projects are marked active. Because only active projects are considered for the cashflow prediction. You can check this right in the Magic Spreadsheet, on sheet “Projects”. If you need to mark any one as active, you need to do it in its budget spreadsheet, in sheet “Status”. The budget spreadsheet is linked from the Magic Spreadsheet, sheet “Projects”.

-

Complete sheets CashflowData1 and 2. Fill down the formulas in columns B and further, to make sure there are as many rows in these columns as there are in column A (where rows are automatically generated). Otherwise, the cash flow graph will show the wrong results.

-

Check project budgets and costs. You can go through the active projects in the Magic Spreadsheet, sheet “CashflowData1”. Sum up a project’s revenues to see if it matches what you remember about the project’s budget. Sum up the costs to see if it’s around 80% of the revenues. You can also look at the predicted project profit margins in sheet “Projects” – each should be ≥20%.

-

Check project cashflows. In Edgeryders OÜ, the cashflow of all revenue generating projects (“client projects”) must stay positive. You can check that in sheet CashflowData2 by progressively selecting the cashflow change values in a project’s column and ensuring that the sum (shown in the footer) stays positive. This information is shown in more comfortable form in the project’s budget spreadsheet, sheet “Cost”.

-

Look at the cashflow graph. The green line is the company’s cashflow prediction. The red line is the minimum of money we always want to keep in the bank. So you can see when the company is approaching uncomfortable or forbidden territory

3.12. Obtaining audited accounts

Some project applications require us to provide audited annual accounts.

[TODO: Process and cost how to get these. Also detailed information about the various types / levels of audits.]

3.13. Contacting our accountants

Starting from November 2018, the accounting service provider to Edgeryders is e-Accounting Estonia OÜ, which is the affiliate of our business service providers, E-Advisors OÜ.

Legal address and banking data:

e-Accounting Estonia OÜ

Pärnu mnt 158, Tallinn, 11317

IBAN: EE151010220274766225

The accountant in charge of our company and our single contact point is Ms. Jekaterina DeVIncentis.

3.14. Monitoring fixed costs

One of our needs is to keep close watch on fixed costs. Fixed costs are those that we incur in regardless of whether we are doing well or not. They are insidious, because they put financial pressure on the company during a dry spell.

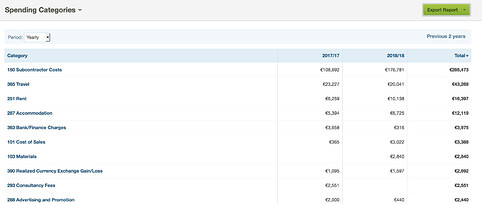

FreeAgent has a helpful report on cost categories. Access it via “Accounting → Reports → Spending categories”:

This goes some of the way, but not much. Some categories (“Accountancy fees”) are indeed entirely attributable to fixed costs; others (“Travel”) are entirely attributable to project costs; but others still (“Subcontractor costs”, “Rent”) have to be split between project and fixed costs.

We have been taking a different path: using the FreeAgent Projects functionality to keep track of fixed costs.

For “pure” fixed costs (accountant, office rent, web hosting, subscription to SAAS like FreeAgent and Zoom) we use a project called “Core”. Core is annualized (Core 2017, Core 2018 and so on), so that we can better compare whether core costs go up or down over time, and by how much).

For “ad hoc” investment projects like the Research Network, we normally don’t bother annualizing. However, if an investment project is meant to be multi-year, you might want to consider whether to annualize it or not. Annualization is valuable if you plan to do something for a long time, and then you need to check that your costs do not grow too much.

Needless to say, all this requires that every cent spent by Edgeryders is always allocated to a project. When reconciling banking transactions, select “More options” to choose a project for the transaction you are reconciling.

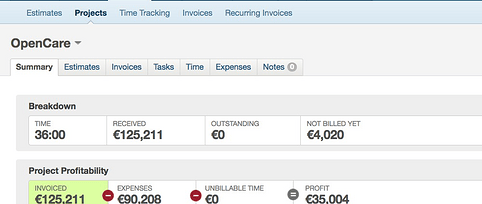

To access the “Projects” functionality, go to “Work → Projects → [select a project]”:

The profitability table shows a grand total for revenues and costs of each project. For Core and other investment projects, there are obviously no revenues, only costs. A breakdown of costs can be accessed from the “Expenses” tab.

3.15. Starting a project in FreeAgent

When creating a new project record in FreeAgent, adhere to the following hints:

Project currency. For the project’s currency, select EUR, even if the currency used in the project’s contract, budget or payments is a different one. Since EUR is necessarily our accounting currency and our only bank account currency, this yields the least confusion about and risk of currency conversion losses / gains. Our budget template (see: Creating and managing a budget) and cashflow prediction spreadsheet (the “Magic Spreadsheet”) is already capable to handle this even when the project’s contract and payments are made using a different currency. See also the additional hints below.

Adjusting the budget. For projects where the contract and payments are in EUR, the budget is a fixed EUR figure and never changes. Enter it as it is into FreeAgent. For projects in a different currency, the budget in EUR is only known after the client paid the last invoice. Before that, it is only an estimate based on past and current exchange rates. Our Budget Template spreadsheet calculates these estimates, but is not yet perfect in getting the right sum in the end. For per-project profitability estimations (the only purpose of the “budget” figure in FreeAgent), these estimates are good enough though. So enter the estimate from the Budget Template spreadsheet when creating the project record in FreeAgent, and correct it at the end of the project, and that’s it.

Managing currency conversion gains / losses. Since we write our invoices in the contract’s currency (for example USD) and use them to explain associated incoming EUR transactions in FreeAgent, there is no need to account for any forex conversion gain or loss using the dedicated FreeAgent feature. That’s because FreeAgent is not aware of any difference in EUR between the invoiced amount at invoice date and payment date. So, nothing special here.

3.16. Managing FreeAgent contacts

Contacts are external people and organisations that the company does business with – like clients and subcontractors, but not employees. However, since directors and other people paid for contract work in Edgeryders OÜ are paid on invoice rather than as employees, they are technically also “external people” and we create contact records for them.

The important things to know about contacts are:

-

FreeAgent needs a contact as references for each invoice / bill we send or receive. Upon creating a new invoice or bill you are prompted to enter the contact it goes to (if it is an invoice) or comes from (if it is a bill).

-

When entering a contact, always mark correctly the field “country”. This affects the VAT calculations.

The FreeAgent manual contains a detailed introduction to contacts.

3.17. Purchasing physical products for Edgeryders

If you buy physical products for Edgeryders OÜ anywhere in the European Union except Estonia, you need to tell the vendor that you are an Estonian company, provide them with our VAT ID and they should not charge you local VAT then. If they do, we lose that VAT because we can only claim Estonian VAT back via pre-tax deduction in our VAT tax returns.

When buying online for a company, the vendors know this and automatically ask for our VAT ID and do not charge local VAT then. This happened already to us with CoolBlue, for example. E-commerce is easier than going down to the shop for us.

3.18. Filing annual accounts with the Estonian revenue agency

The Edgeryders directors are jointly responsible for the truthfulness and accuracy of the company’s annual accounts. Annual accounts must be filed, in Estonian, by June 30th of the year following the one for which they are filed; so, accounts for financial year 2018 must be filed by 2019-06-30.

They are prepared by the accountant, and sent to us by email in draft version. Directors must then review them: a useful process is to compare the profit and loss report and the statement of financial position (as found in the draft final accounts) with their counterpart recorded in FreeAgent under “Accounting → Reports → Balance Sheet” and “→ Profit & Loss”. Ideally, they should be identical; any difference must be understood before directors sign the annual accounts.

Once directors are satisfied that the draft annual accounts are a faithful account of the company’s operations for the year in question, we proceed to filing. There are two parts to this:

-

Authorize the individual accountant (not the company) to file accounts on our behalf. Instructions for doing this are on the Company Registration Portal. This needs to be done by a director with a valid e-ID card. The director must know the individual accountant’s personal code.

-

Instruct the accountant to file the accounts on the Company Registration portal.

-

Sign the accounts:

- Log in to the Company Registration Portal using your E-ID card and PIN1.

- At the top of the page click “Annual reports”.

- Under “Incomplete reports:”, click “View” for the annual report’s entry.

- At the bottom of the page click “Add a digital signature to the report”.

- Add your digital signature using PIN2.

Accounts are valid once signed by any one director. In Edgeryders, we have a tradition of every director signing. Exceptions are possible (for example, when a director does not temporarily have a valid e-ID card), but non-signing directors are still legally responsible for the truthfulness of the accounts, and for any misgivings that might happen connected to the company. There is no legal advantage connected to refusing to sign.

3.19 Verifying that a payment has been made

It can happen that a payment was made by Edgeryders, but does not show on the bank account of the recipient. This has happened especially with non-EU bank accounts. There are two ways to check that there is nothing wrong with the payment.

- Check FreeAgent. If the payment was for a bill (which is most likely), navigate to edgeryders.freeagent.com and retrieve that bill. There are many ways to do it; you can use the search function, or go to the

Billspage. If you do not have the required level of authorization in FreeAgent, ask someone that does. The bill page reports the date at which the payment was made (in blue, as below).

- Check the bank’s website. This is the most authoritative way, and also the most up to date: a payment could already have been made, but not show up on FreeAgent yet because the account statement from the bank was not yet uploaded onto FreeAgent and reconciled. You will have to ask one of the bank account users to do this for you: see above, banking information. Once the payment is located, LHV allows to download two types of confirmation. One in PDF format, which simply contains the information about the sender and the receiver, as well as the date and a serial number for the payment. The other one in BDOC format, which contains the same information plus a digital signature of the bank, the authority issuing the cryptographic keys for the signature etc. BDOC requires specific software to be opened.

3.20. Recording payments out of the BNP Paribas Warsaw bank account

We also have an account with BNP Paribas in Warsaw. This was necessary, because one of our client won’t touch anything else than USD; LHV does not have a correspondent bank in the USA (and does not hope to get one soon); and other Estonian banks turned us down.

We use this account only rarely, and its online banking facilities suck. So, instead of investing time in automating a process of downloading transactions from it, we use instead a manual process to account for the transactions that go through it.

-

Log into the online banking facility and download the account statement (in PDF).

-

Go to the correspondent account ledger on FreeAgent, starting from the banking page. It is the one marked “BNP Paribas USD”.

-

Do the following for each transaction on the account statement:

- On the top right of the screen, click on “More → Add transaction”.

- Fill in the form that opens, with the transaction category, date, amount, etc. The amount is, of course, recorded in USD.

-

When you are done, proceed to reconciling the transaction as normal. The goal is to have no unreconciled transaction.

3.21. Accounting manual: bookkeeping cheatsheet for Edgeryders

Accounting in Edgeryders works like in any other company, in the sense that we adhere to Estonian law, which in turn incorporates, by and large, internationally accepted standards for financial reporting. However, there are a few tips and tricks we developed to make our bookkeeping easier to read and easier to do. These are collected in the Bookkeeping Manual.

4. Other processes

4.1. Signing for the company

In general

-

For identification. To sign forms for (legal, financial, …) identification purposes, the signature of one director is enough. This applies where a form says “signature of authorized representative”.

-

For contracts. In legal terms, each director has full representation powers. Any limitation to this must be made part of our own rules and encoded in our Articles of association.

-

Company seal. It is no longer necessary for Estonian corporations to have a seal and we do not have one.

SignRequest

We use SignRequest to digitally sign all documents that need it, such as contracts and time records. It does not use cryptographic digital signatures but rather authenticates the user via e-mail address and / or mobile phone number. This is certainly sufficient for cases where any kind of digital authentication is acceptable, such as for H2020 time records. It is probably sufficient by way of mutual agreement for contracts where the law does not require a specific way of signing. However, we did not look into the legal details of that.

Notes about our usage of SignRequest:

-

Never ever delete from SignRequest. Never delete signed documents from the Edgeryders SignRequest account, as that is the only unforgeable / authoritative evidence of the document signing. All PDFs downloaded from SignRequest could be forged in principle, as they are not digitally signed by SignRequest to protect them against tampering.

-

Syncing to Google Drive. When the last signatory signs, the signed document, attachments (if any) and signing log are automatically saved into the admin@edgeryders.eu My Drive → SignRequest folder. This folder is only accessible to directors for data protection reasons. All signed documents from the Edgeryders SignRequest account since the beginning of its use have been put in there.

-

Sorting in synced files. The per-document sub-folders that SignRequest creates in the Google Drive target folder should be moved to the right places in the Team Drives folder structure. They will not be re-created on Google Drive by SignRequest, so there will be no redundancy.

When moving them, rename these per-document folders using an adequate naming schemes. That provides a way to find any signed document again quickly in Google Drive. For example, we use the following naming scheme for the folders of signed time records:

Time Records - [project] - [collaborator] - [yyyy-mm] -

Finding the authoritative version. If there is a need to also find the authoritative version on SignRequest for a signed document found on Google Drive, one can quickly locate it by searching in SignRequest → My documents for the internal SignRequest filename mentioned in a document’s audit log PDF.

-

H2020 time records. We provide detailed instructions for signing time records for H2020 projects in Reporting for a H2020 Project § Signing Time Records.

-

Dealing with e-mail delivery. In case that the SignRequest e-mails for signing documents do not reach the recipients due to classification as spam or similar, you have two options. First, you can tell your participants to create a whitelist entry for the

no-reply@signrequest.come-mail address or entiresignrequest.comdomain. Second, you can make sure that your recipients have a signrequest.com account for the e-mail address you send the sign requests to, and then tell them via a different channel to log in there and sign the new sign request that you sent them. SignRequest does not require to have an account to sign, and will not tell you which recipient address has or does not have an account associated to it, so you will have to ask your recipients about that directly.

Estonian digital signature

Directors of Edgeryders OÜ must be e-residents of Estonia. This allows them to digitally sign documents and contracts using the facilities provided by the e-residents scheme. This is only useful in communications with the Estonian state though, as everyone else will not want to use their custom tools to unpack the files and check the signatures.

Some hints for using the Estonian E-ID cards to sign petitions and documents:

- When trying to sign a petition in the Estonian company portal, note that the process does not work using Chrome under macOS, as reported by @hugi in 2021-05.

Signing on paper

When you sign any Edgeryders document on paper, you have to:

-

Write your name’s initials into the bottom right corner of every page of the document that has text on it.

-

Add date, name (if required) and your signature to the bottom of the document.

Initialing the pages is required for a document to be considered “properly signed” in some countries, notably Belgium.

4.2. Estonian Statistical Service “E-Stat”

The company is registered with E-Stat, the portal of the Estonian statistical service. This is compulsory. @alberto is formally accredited as the party responsible for providing information to Statistics Estonia.

4.3. Participating in EU funded research

Edgeryders OÜ is registered on the European Union’s Beneficiary Register as of March 20th, 2017.

- PIC: 912799780

- Account administrator: Marina Batinić

- LEAR: Alberto Cottica

4.4. Managing an Edgeryders project

This is treated in its own topic here:

4.5. Accessing Edgeryders accounts on third-party platforms

Information about how to access the various social media etc. accounts registered for Edgeryders OÜ is contained in its own, access protected topic here:

“Login Credentials for Edgeryders Accounts” ![]()

4.6. Producing an Edgeryders report

This is covered in its own topic:

4.7. Joining the Edgeryders management board

This is covered in its own topic:

https://edgeryders.eu/t/joining-the-edgeryders-management-board/7589

4.8. Using edgeryders.eu e-mail addresses

This is covered in its own topic:

https://edgeryders.eu/t/using-edgeryders-eu-e-mail-addresses/3365

4.9. Setting up an Estonian Osaühing (OÜ) company using E-ID

We have treated this in detail in its own topic, see below. It also covers the process to change our articles of association any time after setting up such a company.

https://edgeryders.eu/t/setting-up-an-estonian-osauhing-ou-company-using-e-id/5930

4.10. Setting up an Estonian one-person company using E-ID

Noemi describes this in detail in its own topic:

https://edgeryders.eu/t/setting-up-an-estonian-one-person-company-using-e-id/6400

4.11. Data protection compliance

The Data Protection Inspectorate is the authority responsible for enforcing data protection law in Estonia. We have reached out to them, inquiring about compliance processes. They replied on 2018-05-14. The reply is signed by Kristjan Küti, Senior inspector, authorised by Director General.

The companies do not have to register their sensitive data processing from 25th of May, 2018 and the old register will be archived. After the 25th of May the companies have to inform data protection authorities about the appointing of Data Protection Officer (articles 37 of GDPR). The companies which are established in Estonia can do it through the e-Business register. The GDPR superseded the Estonian Data Protection Act.

The Data Protection Officer is currently Matthias Ansorg. Should that change, the name and email address of his replacement needs to be added to Edgeryders’ entry in the company registration portal. This can be done online by any director.

4.12. Onboarding a collaborator

The process of bringing in a new collaborator to Edgeryders is documented in detail here:

https://edgeryders.eu/t/onboarding-a-collaborator/10222

4.13. Adding a management board member

Detailed instructions are here:

https://edgeryders.eu/t/registering-a-new-member-of-the-edgeryders-management-board/11723

Authorizing third parties to submit tax filings on behalf of Edgeryders

Like many companies, Edgeryders delegates to a professional accountant the task to submit tax filings and in general interact with the Estonian Tax and Customs Board (EMTA). An accountant needs an authorization in order to be able to do so. The authorization needs to be given by someone who already has powers of representation for Edgeryders, normally a director.

To give someone permission fo file taxes on behalf of Edgeryders:

- Navigate to https://www.emta.ee and log in with your Estonian e-id card.

- You will see a list of businesses your registry code (the ID number on your card) is associated with, which includes Edgeryders. By clicking on the company name, you enter the EMTA portal as a company representative.

- Click on

Settings => Access permissions - From the menu on the left choose

Access permissions of representatives. You will see a list of people and legal entities who either have permission or have had it in the past. ClickNew access permission - In the form you see, enter the registry code of your chosen accountant, or their name, then click

Search. The portal responds by giving you the appropriate record of the accountant. Note: the accountant can of course be a company. Click onNext. - Decide on the validity of the permission. Normally this is open-ended.

- Under the

Permissionsheading, click on theSearchbutton. This is a little counter-intuitive, because the form for the search is empty, but it is correct. The portal will show you a list of pre-assembled bundles of permission. ChooseAccountant's package, then click on theAddbutton.

To revoke someone’s permission to file taxes on behalf of Edgeryders:

- Repeat steps 1 to 4 above.

- Find in the list mentioned in step 4 above the name of the person or entity whose permission you want to revoke, then click on it. A pencil icon appears on the right: click it.

- Under

Time of discarding access permissionsclick on theTerminate right awayswitch, then click onSave.

Note that the authorization of directors cannot be managed from the EMTA portal. All directors are automatically given full permission. When someone is removed from the management board, their authorization to operate on the EMTA portal is automatically revoked.

4.15. Creating and documenting a process

You’re welcome to process innovate. When you discover a lack of structure or organizational mess in the Edgeryders organization, you are welcome and encouraged to create your own process. Thank you for making our organization a better place! ![]() Your process will then serve as “the official way to do it” in our organization, until somebody sees a need to improve or replace the process again.

Your process will then serve as “the official way to do it” in our organization, until somebody sees a need to improve or replace the process again.

But always document it! To be an official process, your process must be documented, and its documentation must be navigable from the relevant manual topic in Documentation & Support → Collaboration. Otherwise, as far as our collaborators are concerned, it does not exist. There’s just no practical way that our collaborators would bookmark a multitude of topics in various categories to know how things are done in Edgeryders.

Conventions for documenting a process. We have a standard practice for documenting our processes, mostly developed by @matthias. You can glean it mostly from looking at our existing manuals, and from the notes below. It would be great if you follow this as much as possible – no big deal if it’s not perfect, as @matthias will tidy things up when doing the next pass over our documentation.

-

A manual document about a process is a topic in Documentation & Support → Collaboration of which the first post of the topic is set up as follows:

- made into a wiki

- tagged manual

- owned by user @community_wiki

- using the

icon at the start of its title

icon at the start of its title - made into a sticky topic in its category

- using our convention for the structure of long or complex documents

-

You can outsource parts to other topics, linked from the manual topic. But these other topics should also be wikis, tagged manual-section, owned by user @community_wiki and follow the same convention for content structure.

-

There should not be inconsistencies between your new process and any other process that is documented already. If necessary, you will have to modify the documentation of other processes as well.