This topic is a linked part of a larger work: “Edgeryders OÜ Company Manual”

Content

3. Expense reimbursement process

- 3.1. Request per-diem payments for travel (if applicable)

- 3.2. Request expense reimbursements (if applicable)

- 3.3. Request expense reimbursements for those without an account (if applicable)

- 3.4. Fixing over-reimbursements

1. Introduction

[TODO: Content of this section.]

2. Setup

[TODO: Content of this section.]

3. Expense reimbursement process

Just follow all applicable steps in all sub-chapters, in the order they appear.

And please allow one week for the payment to happen, and the usual transmission time for bank transfers on top of that. We make our payments once a week on Mondays, with exceptions only to avoid catastrophes.

3.1. Request per-diem payments for travel (if applicable)

Travel allowances may be granted either based on expense receipts (see below) or using a (much simpler) per diem mechanism. This depends on the project, your project manager, and your own agreement.

When using the per-diem mechanism, use the Estonian regulation and the per diem rates for EU member states.

To submit a payment request for per diem expenses, please send an invoice using the regular invoicing instructions. Just that you have to issue a separate invoice for per diems – do not add this to your regular invoices for services.

Also note that we cannot advise you how you have to account for per diem money for proper taxation in your country. To deduct your travel expenses as a business expense, you may still have to collect and book receipts. But with per diems, you don’t have to submit these receipts to Edgeryders OÜ.

3.2. Request expense reimbursements (if applicable)

This process applies only if you have spent own, private money for third-party products and services needed and agreed by the Edgeryders company, and want to claim reimbursement.

-

Make expenses and collect the original (physical or digital) receipts for them.

-

Digitize and aggregate your expense receipts. The preferred format is PDF with A4 page size, but JPG and PNG images (<1 MiB) are also acceptable. To digitize the receipts, some company members use the Expensify app to take captures and receive PDFs in their emails.

Optionally, to aggregate expenses for lower efforts of entering them lateron, you can combine receipts of the same expense category into one PDF document each. Do not create aggregates of different types of expense receipts, as that would not allow proper categorization of expenses for tax purposes. For example, travel tickets and restaurant bills should not be aggregated together.

-

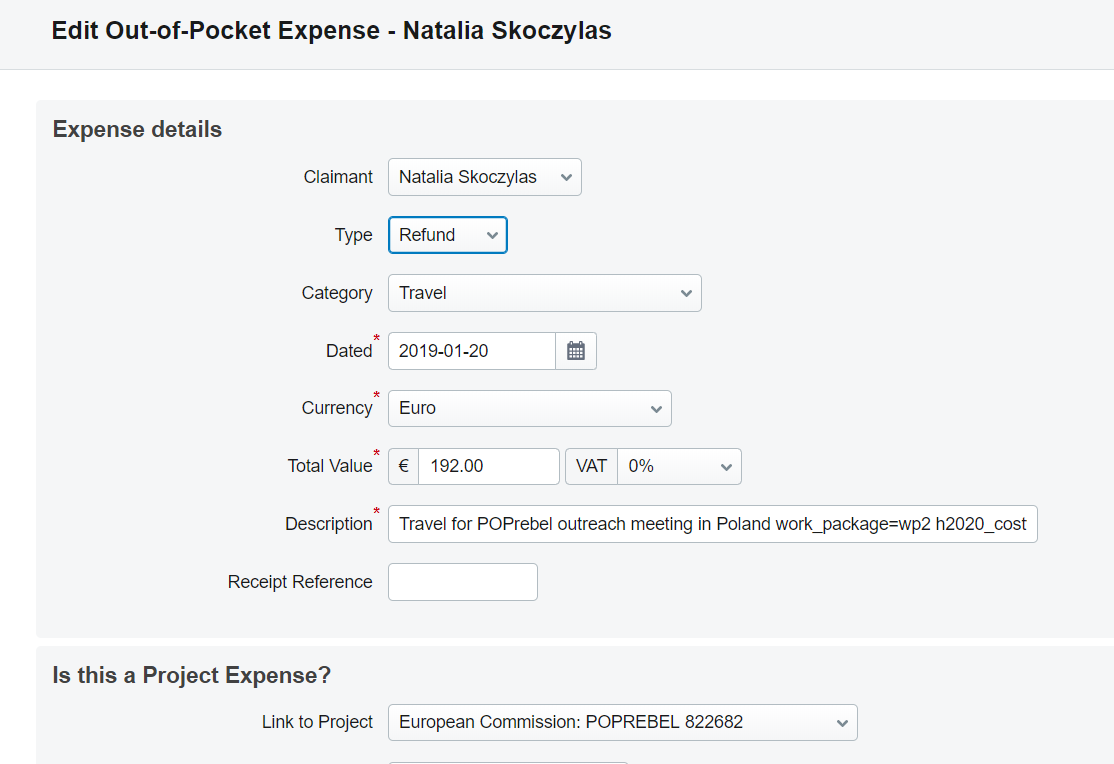

Add your expense receipts in FreeAgent. For each of your (aggregated) expense receipts, created above:

- In FreeAgent, click on “Expenses” in the main menu to see your expenses.

- Click “Add new expense” in the top-right.

- Create a new record for every receipt or receipt aggregate (containing multiple receipts of the same expense category). There will still be only one payment to you, combined for all your records of not-yet-reimbursed expenses.

- Enter the expense type. Between Refund and Payment - choose Payment, since that was the action you took. You did not refund anyone, you paid an expense.

- Enter the expense category. For any expense for paid project work done by Edgeryders for a client, choose one of the “Cost of Sales” categories, if necessary just the general “Cost of Sales → Cost of Sales”.

- Enter the expense date. Should conform to the date on the expense receipt that you will upload.

- Enter the expense amount in the currency of the receipt and upload as attachment the receipt reference. If you are claiming in a currency different than the Euro, note that we usually reimburse at the historic rate of the expense receipt’s date.

- Enter the VAT amount. Enter the amount of VAT contained on your receipt(s) that Edgeryders OÜ can claim back via pre-tax deduction from European Union governments. If the invoice is issued in a non-European Union country, it’s simple: enter zero, we can’t claim back contained VAT if any. Otherwise, if in doubt, also enter zero as the “safest case”.

- Fill into “Description” a text “{projectname} {expense type}”, for example: “OpenCare travel to Brussels”.

- Link it to a project by filling the “Link to Project:” field. This is important to make our project-level accounting work.

- Upload the receipt. As prepared previously, see above.

-

Check how much expense reimbursements you are owed. Usually it makes sense to let expense receipts accumulate in FreeAgent until you have enough registered to make a transfer to you economical. So you need a way to check how much you are owed by Edgeryders, as follows:

In the horizontal main menu, navigate to “Expenses”. From the “Show:” drop-downs, choose your name and “Recent”. (The balance owed to you will only show if you choose “Recent”!) Now, the reimbursements owed to you is at the bottom right of the table (row with the newest date, column “Balance Owed”).

Another way to check the balance owed to you is to go to “Accounting → Reports → Show Transactions”, and there select account “905-{nn} Expense Account: {your name}”.

3.3. Request expense reimbursements for those without an account (if applicable)

Applicability. If the person form whom you are registering expense claims has a FreeAgent account, do not use this process. Use the “Request expense reimbursements” process from above, as is more comfortable – it will convert currencies automatically using the exchange rate from the day of the expense, and sum up the total expense claim. It even allows, where needed, to pay people an advance for expenses they will make in the future.

However, for occasional collaborators, event participants who are owed funded travel reimbursements etc. and anyone else who is owed a reimbursement without having their own FreeAgent account yet, it is impractical and inefficient to let them register their own reimbursement claims. It is faster and simpler to create contacts and register expense claims as bills than to create users and train people how to enter their expense claim data.

Instructions. In these cases, simply let them send you a payment request that contains the summed-up amount (in Euros), the account to pay to, and the receipts on the following pages of the same PDF document. Then register this document the same way as an invoice from a supplier. Just that it should not contain the word “invoice”, and does not need an invoice number or other formalities.

Aggregating expenses into bills. For what payment receipts can be put together into one bill, the same rules from above related to aggregating payment receipts apply: you can combine receipts of the same expense category into one bill. Do not create aggregates of different types of expense receipts, as that would not allow proper categorization of expenses for tax purposes. For example, travel tickets and restaurant bills should not be aggregated together.

3.4. Fixing over-reimbursements

If the company mistakenly reimbursed expenses in excess of those actually incurred, there are two options:

Over-reimbursement of a regular collaborator. If a moderate amount was overpaid to a person who will incur other expenses in the future for the company, nothing has to be done: FreeAgent show the over-reimbursement with a negative value due to the collaborator (i.e. money due to be paid back to the company), and this credit will disappear and eventually reverse as more expense records are added over time.

Over-reimbursement in other cases. If the amount is not moderate or paid to a one-time collaborator, the transaction should be reversed as follows:

-

The collaborator who was paid the extra money should refund it via bank transfer.

-

The Edgeryders payment manager reconciles the original money out transaction:

- Split the original transaction into two smaller transactions (instructions).

- Reconcile one of the two, for the amount actually due to the collaborator, as “Money paid to user → Expense payment”.

- Reconcile the other, for the remaining balance, as “Other money out → Payment from contra account”. The contra account is just a transit account used for housekeeping.

-

The Edgeryders payment manager reconciles the incoming transaction made by the collaborator in favor of the company as “Other money in → Receipt into contra account”.

TODO: There might be a simpler process, somehow utilizing the “Type: Refund” setting when making an expense claim.