This topic is a linked part of a larger work: “Edgeryders OÜ Company Manual”

Content

1. About this document

2. Always assign transactions to projects

3. Accounting for SAAS (Software As A Service)

- 3.1. When the software is NOT a direct cost of a EU project

- 3.2. When the software IS a direct cost of a EU project

4. Accounting for grant income

5. Recording multi-annual grants

1. About this document

Edgeryders keeps its books in accordance to International Financial Reporting Standards. At the time of writing, the company uses a cloud accounting service called FreeAgent.

This document covers neither the general principles of how to do bookkeeping (covered by IFRP), nor specifics of handling the FreeAgent software (it has its own documentation, and customer support is excellent). Rather, its purpose is to point to certain non-obvious practices that serve Edgeryders in particular well, and that we have decided to adopt.

2. Always assign transactions to projects

Projects are a functionality offered by most accounting softwares, including FreeAgent. They allow to keep separate accounting for different lines of activities within the same company. Projects have no legal status, so you are never required to keep track of them by tax laws; but doing so is informative about how the company is doing, and what it could be better.

Projects can be created from the FreeAgent main menu, choosing Work => Projects => Add new project. When creating a new project record in FreeAgent, adhere to the following hints:

Project currency. For the project’s currency, select EUR, even if the currency used in the project’s contract, budget or payments is a different one. Since EUR is necessarily our accounting currency and our only bank account currency, this yields the least confusion about and risk of currency conversion losses / gains.

Adjusting the budget. For projects where the contract and payments are in EUR, the budget is a fixed EUR figure and never changes. Enter it as it is into FreeAgent. For projects in a different currency, the budget in EUR is only known after the client paid the last invoice. Before that, it is only an estimate based on past and current exchange rates. Our Budget Template spreadsheet calculates these estimates, but is not yet perfect in getting the right sum in the end. For per-project profitability estimations (the only purpose of the “budget” figure in FreeAgent), these estimates are good enough though. So enter the estimate from the Budget Template spreadsheet when creating the project record in FreeAgent, and correct it at the end of the project, and that’s it.

Managing currency conversion gains / losses. Since we write our invoices in the contract’s currency (for example USD) and use them to explain associated incoming EUR transactions in FreeAgent, there is no need to account for any forex conversion gain or loss using the dedicated FreeAgent feature. That’s because FreeAgent is not aware of any difference in EUR between the invoiced amount at invoice date and payment date. So, nothing special here.

Contacts. In FreeAgent, each project must be assigned to one and only one contact (a client). When creating a new project, check that it corresponds to an existing contact. If that is not the case, create a new contact from the Contacts menu item. Creating a contact is straightforward, except for the treatment of VAT.

-

A contact is a client if it buys services from Edgeryders – for example, consulting. In that case, select

Only if contact is also based in Estoniafor theCharge VATfield. -

A contact is a funder if it gives grants to Edgeryders – for example, the European Commission has awarded us research grants. In that case, select

Neverfor theCharge VATfield. This is necessary because we issue “quasi-invoices” to funders, in order to keep our accounting by projects straight.

3. Accounting for SAAS (Software As A Service)

Edgeryders uses several services that provide access to cloud software that we can use. Some examples are Google Suite, Canva, MailChimp, FreeAgent and others. All these services work with ongoing payments, generally monthly: each month, each of them takes from our account the billed amount.

To account for these, the best practice would have us log into our respective accounts, download each bill, upload all of them onto FreeAgent, and then operate reconciliation. But that is a lot of overhead, so we do not do it.

3.1. When the software is NOT a direct cost of a EU project

Instead, we do this.

-

After uploading our bank transaction statement into FreeAgent, locate the appropriate transaction(s). The

Descriptionalways have the name of the company that bills us, for example this is for a service called Duxsoup:(..4947) 2021 08 07 04:54 Duxsoup* Dux Soup\Craenlaer\Ulvenhout Br\4851 Tk Nh Nld Sender/Receiver: Duxsoup* Dux Soup -

Click on

More options. In the screen that opens, you can assign that transaction to a project by choosing an item in theLInk to projectdrop-down menu. -

In

Select a typechoosePayment. InCategorychooseComputer software. -

Finish by clicking on

Create new explanation.

All this is part of the weekly admin work.

3.2. When the software IS a direct cost of a EU project

The above is a legally correct way of accounting for these expenses. However, it creates a problem for European research projects. The problem is this: in case of audit, the auditors want to see the bills, not just the payments. Additionally, the EU has its own cost categories for direct costs of projects.

So, we do this.

-

We identify a person who is responsible for keeping a tab on these costs. This will be financed with project management person-months.

-

This person keeps a list of which SAAS are being used for which projects. The list should be a wiki in the workspace of the Research Network. Ask @nadia if in doubt, she is the one who uses these services most.

-

At regular intervals – at least monthly – the responsible person logs into the accounts of the service and downloads the latest bills.

-

She then opens the

Banking => Bank accountstab of Freeagent and chooses the relevant bank account, normally LHV at the time of writing. -

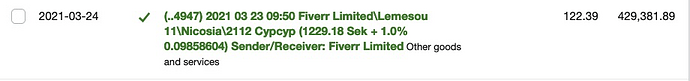

Identify the payments by their amount. Sometimes they will be already reconciled, and show up in green, like this:

-

Select it and click on

More options. -

In the screen that opens, assign it to the correct project.

-

Change

TypetoPaymentandCategorytoOther goods and services. -

Click on

Upload a fileand upload the bill she downloaded in 3. Of course, the name of the service /company must coincide, and so must the amount. The amount requires a bit of attention, as the bills are sometimes expressed in USD or SEK whereas the payments are always expressed in EUR.

4. Accounting for grant income

Edgeryders has two main sources of income: payments from clients (generally from consulting projects) and grants from funding agencies (for example for research or arts/culture projects).

To get paid by clients, the company of course issues invoices. Grants, on the other hand, normally do not require invoices. This poses a small problem with accounting, as we have to issue pro-forma invoices ourselves to associate the grant money with projects in FreeAgent.

If you manage a project funded by a grant, proceed as follows.

-

Create a FreeAgent project:

Work → Projects → Add new project. You might also need to create a new Contact for the funding agency, as all projects must be associated to a Contact. -

Create an invoice for the amount of the grant, and assign it to that project. Choose income category “Grants” for each invoice item. This is possible in the invoice viewpage (example) after ticking the checkbox for “Show Income Categories (will not appear on sent invoices)”.

-

When the payment comes through the bank, reconcile it as

Invoice receipt.

(Note about no longer requiring journal entries)

Previously, there was a fourth step here that required you to create journal entries to move the income from “Sales” or “Other commercial income” to “Grant income”. This is no longer needed, since FreeAgent added a feature for custom income categories, and we created one “003 Grants”. As a side effect, grants will be included in turnover on our Profit and Loss report, which is technically not correct. However, this does no harm, as preparing the yearly report anyway involves manual work by the accountant, and never just copy&pasting a “turnover” figure.

5. Recording multi-annual grants

Some grants are paid to us in advance (for example those for EU Horizon 2020 projects). It is possible that the project that the grant relates to extends over the financial year in which the payment is made.

If the payment is recorded as grant Income, it arbitrarily inflates profits for the first year covered by the grant and depresses them for the other years. In Estonia, this has no implications on corporation tax and liquidity (since tax is only paid on distributed profits, not on retained profits). But since it’s a distortion, we better account for it differently:

The principle is that, in each financial year, you should only record an amount of grant income equal to the money you spent on that project in the same year (plus the marginality, if any).

Example: Edgeryders receives in March 2016 full payment for a grant of 10,000 EUR. Half of it is to be spent in the same financial year; the other half is to be spend in the next financial year.

-

When the incoming payment of 10,000 shows up in the “banking” section of FreeAgent, explain it (the full amount) as

Other Money In → Receipt into Contra Account.Explanation of the Contra Account concept

A contra account is a sort of stash: you take the cash (only accounting wise, of course, the money actually stays in the account) and stash it into this fund. The bank account balance in Free Agent will still show the regular bank account balance, but for accounting purposes, the portion of money in the contra account stays invisible (and that’s its purpose).

In more detail: FreeAgent explains a contra account as a “holding bay for transactions that will come into your business accounts and go straight back out again” (see). In more general terms, it is used to make adjustments to an associated main account while keeping its transaction history intact. Such adjustments can be needed for various purposes, for example when a business receives money in error and accounting-wise does not want that money to be counted among its business assets while it has it on its bank account.

While usually every main account can have its own associated contra account, in FreeAgent there is only one contra account for all bank accounts together. Technically, the way it adjusts the balances of the main account(s) is this: when “moving” money from a main account to the contra account, the balance of the main account stays untouched, and a corresponding negative balance is created on the contra account. So the money does not really move as in a normal transaction between accounts, it is only offset, so that the sum of main account and contra account (as calculated on the balance sheet) hides the sum “moved” to the contra account.

Bank accounts are asset accounts, which have a debit balance as their normal balance, so the FreeAgent contra account correspondingly has a credit balance as its normal balance. Now the FreeAgent balance sheet report, when summing up current assets, will sum up all bank accounts and deduct from that the credit balance of the contra account, indicated by listing the contra account among liabilities rather than assets. (So typically, the contra account will appear with a negative sign in the FreeAgent balance sheet report, offsetting parts of the bank account balances. But, to make the confusion complete, under some circumstances the contra account can have a negative credit balance, which is shown as a positive debit balance in FreeAgent, and then appears as a positive balance on the balance sheet report, that is, as an asset account.)

For multi-annual grants, the idea is to stash the grant into the contra account (“Receipt into contra account” in FreeAgent) so it does not count as assets, and then take out portions according to the expenses incurred during the project (“Payment from contra account” in FreeAgent). But due to its nature as an offsetting account, neither the receipt into or the payment from a contra account is a regular accounting transaction. This is true even though FreeAgent creates always pairs of entries for these actions, one for the bank account and one for the contra account; these appear similar to a regular accounting transaction at first glance, but are not: for “Receipt into contra account”, a debit entry is created on the bank account and a credit entry on the contra account. For a regular transaction that moves money from the bank account to the contra account however one would need a credit entry on the bank account and a debit entry on the contra account.

Rather, this is how it works:

-

For Money In explained as “Receipt into contra account”, the main account balance is debited by the given amount (it increases), and the contra account balance is credited by the incoming amount (its credit balance increases, and thus its offsetting power increases). This adds money to the bank account and offsets the same sum in the contra account. The high-level concept is that the money comes from the outside and goes directly into the contra account (hiding from asset accounting), hence the name. As both the main account balance and the offset in the contra account changes, this is income with no net effect on the balance sheet. It is hidden from accounting in that sense.

-

For a manual banking transaction of type “Other Money Out → Payment from Contra Account”, the main account balance is credited by the given amount (it decreases), and the contra account balance is debited by the transaction amount (its credit balance decreases, so its offsetting power decreases). The high-level concept is that the money goes out from the contra account to some external destination, hence the name. As both the main account balance and the offset in the contra account changes, this is an expense with no net effect on the balance sheet. It is hidden from accounting in that sense.

-

-

You now want to account for the part of the incoming payment that really pertains to the current year: 5,000 EUR. Create two manual banking transaction. The first one will take money out of the contra account (accounting wise!) and the second one will put it back into the regular bank account (again, only accounting wise!).

Useless details

Technically, these are two separate transactions, one with an unspecified destination, and the other with an unspecified source. On the high level, these are assumed to be connected together, identifying the unidentified destination and source with one another. They cancel each other out and have no net effect on the bank balance, so it is a usable model for “moving money from contra account to regular account”. It is still a hacky model: usually a transaction should be modeled by a single accounting transaction. But that is not possible here due to the way FreeAgent works, namely because journal entries for a transaction between bank account and contra account cannot be created since journal entries are not possible at all for bank accounts (code 750-*).

The first transaction to create is

Other Money Out → Payment from Contra Account, for 5,000. Call it something like[project name] 2016 revenue. -

The second transaction to create is an invoice for 5,000 EUR. Assign it to the project (or projects) associated to the grant. Then mark all invoice items as being of income type “Grants”. This is possible in the invoice viewpage (example) after ticking the checkbox for “Show Income Categories (will not appear on sent invoices)”.

Once you have created the invoice, mark it as sent, then click on the

Add a manual paymentbutton and confirm.You need to do all this because an invoice is the only way for us to track profitability of grants, as explained in more detail above.

-

At this point, you have 5,000 in the contra account; 5,000 recorded as grant income for the current financial year (FYE 2016); 5,000 of costs related to the project for the same financial year (not mentioned in the example, assumed to happen between 1 and 2). The income of 5,000 is associated to the project counted into profits, but not the rest of the payment, that remains available for the following financial year.

-

When the next financial year comes, repeat steps 2 and 3.

-

At this point, you have emptied the contra account (its balance is zero). You also have 5,000 recorded as grant income for the second financial year; and 5,000 worth of costs for the second financial year.