Hello @yannick, that is a very interesting problem you pose. Here’s a few thoughts, based on skimming the Accounting paper you linked (thanks!) and my own experience as – I guess – Edgeryders’s de facto comptroller, reasonably versed in double entry accounting not only in theory, but in the practice of a small firm. I have three thoughs to contribute:

1. Where is your data source?

Accounting (of any type, even just making a list of things that happen or things you have) is very, very useful. Even small businesses quickly outgrow human short-term memory. Reorganizing accounting information into a coherent whole can be intellectually satisfying. But here’s the catch: assembling the accounting information is not easy, at all. You need to keep a close watch on everything you do, and record it. And I mean everything: if you lose or forget part of the data, your whole information system is compromised. There is a reason why the popular image of the accounting clerk is that of a fussy person, attentive to detail.

What makes good quality accounting accessible even to small firms in this age is electronic banking. If:

- You do all of your transactions via a bank.

- You have online access to your bank account (ideally via API)

Then the data collection phase is 90% done for you. For something like 20 EUR a month, you can get supergood accounting SaaS platforms, that import your banking data. All you need to do is to interpret each one of them: this expense went to buy a depreciable asset, that was a salary payment and so on.

The viability of alternative models of accounting depend on what other (non-financial) information they need, and how hard it is to get it. For example, the Guerrilla Translations model requires to track three flows: money, physical output and time. They are in luck with physical output, because they are translators, so they can just assume uniform quality and approximate output with word count. This would be difficult if they were, say, jewellers.

We have a small experience with time. In the early days of Edgeryders, @matthias proposed we all time log. For him, as a software developer, it was already part of his routine. Everyone else pushed back: too bureaucratic, too complicated and weird. Later on, we got involved with EU project that require us to produce timesheets, and through this experience we came to realize that time logging is actually useful to acknowledge everyone’s contribution, and to protect people from self-exploitation. Now we do it, more or less – or rather, some do it consistently, and others don’t. We can already do some kind of analysis on logged time.

If we were to convince ourselves to switch to a system that needs consistent time logging, we would probably be able to do it. But it took seven years for the culture to set in! Bottom line here is: no accounting system is viable unless people are prepared to do the legwork required. At least, not in Edgeryders. Financial flows are super-centralized (everything goes in and out of one, or a few, bank accounts) and this makes them easy to track them. Tracking work time, instead is inherently decentralized.

2. Do you really need more formal analysis?

Tracking time can be a way to assess everyone’s contribution. In early Edgeryders, Matt proposed it as a way to keep track of sweat equity, as we had no money at all at the time. But we decided that a better way to do the same thing would be to decide we would all own an equal share of the new company, and could trust each other to pull our weight towards this end. We could see two advantages to zero monitoring: it has almost no overhead (measuring is costly) and builds trust.

I still think that was a good call in the circumstances. We could easily fit the whole company in our heads (4-5 people, no financial assets). This is now no longer the case. Maybe your business has already reached the stage where the benefits of gathering more information are worth its costs, Yannick. But in general, my advice would be: if you do not really really need it now, do not do it. Wait it out.

3. Is the new, fancy standard really better than the old boring one?

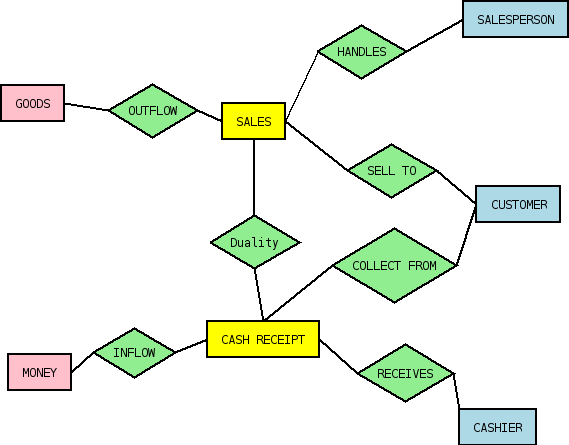

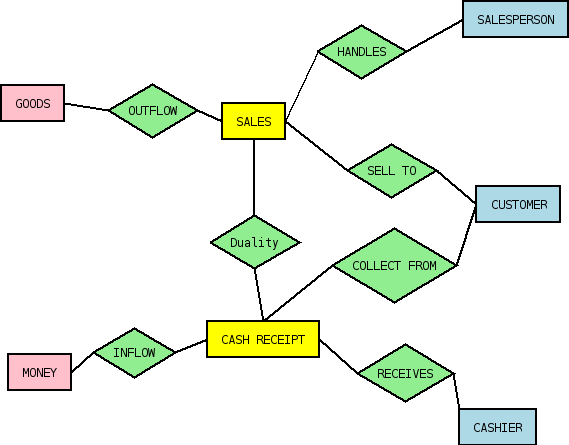

I looked up some extra info on the REA model (on Wikipedia, as I am lazy). And found this:

It does not tell me anything that I don’t know with a glance at my (traditional) accounting software. If you were a very large organization, or – even better – network thereof, then I do see an advantage: explicit tracking of agents. But again, even in traditional accounting platforms there are several ways to keep track of agents (normally, but not necessarily, individuals).

Additionally, even if you were to adopt some alt-accounting system, it has to be on top of normal double-entry accounting, mandated by company law.

In conclusion, it seems to me that you would need a concrete and urgent case for adopting anything new, rather than stretching good ole double entry bookkeeping (for example, in the case of Edgeryders, adding time logging).

With that said, if you implement REA or other fancy systems, I would be grateful for learning about your experience. Maybe a webinar?