I asked urban this in august, and they confirmed that at the moment the text we have been working with is still applicable (see my email in the mailbox titled “Demande d’information - taxe sur une nouvelle construction”).

The question though is whether it would be 50 or 65 euros, depending on whether the site is on “une zone affectée par le changement de PRAS” (something about the fact that the terrain is in a zone where a “changement d’affectation” was decided in 2013).

You’ll see that the person mentions that this is not taxe de la batisse and that taxe de la batisse is what is due to the commune. But everybody seems to be confused about that, so I think let’s just call it taxe de la batisse… I’ve saved all the documents regarding these different taxes in a folder called “Taxes d’urbanisme” under the estimation folder in team finance’s folder.

I think it’s good that we get all this confirmed through another source though. Better safe than sorry…

.

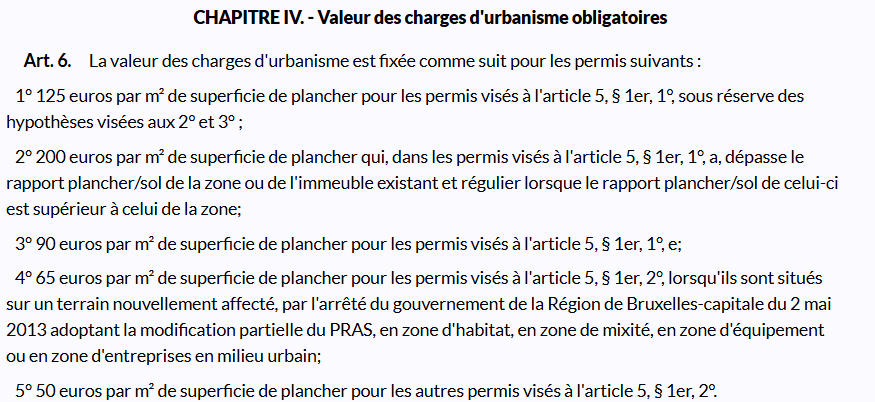

Here is what the text say regarding the charge d’urbanisme:

.

.

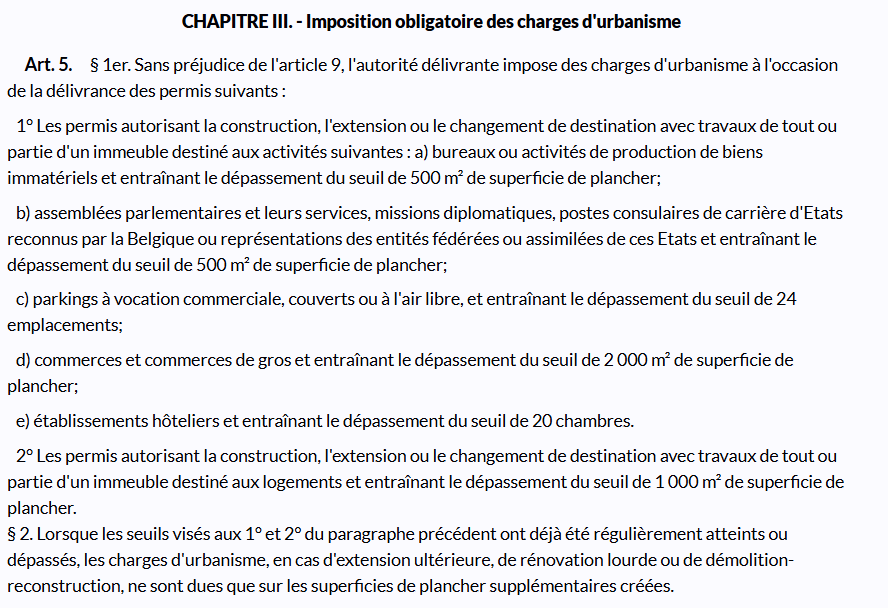

And here is the classification of buildings:

.

So we are paragraph §1er 2°, so 50 or 65euros per m2

.

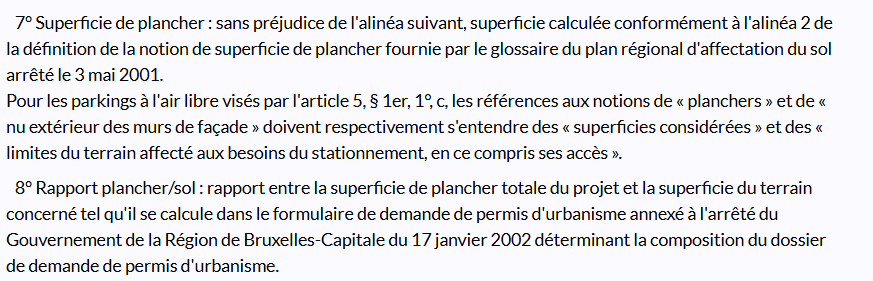

And the surface de plancher:

.

.

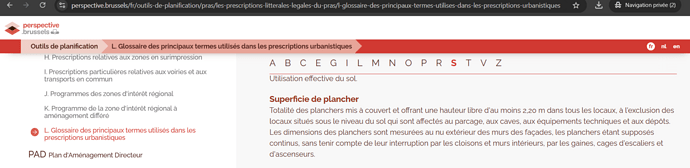

which I think refers to :

.

(from “Glossaire des principaux termes utilisés dans les prescriptions urbanistiques”, which I think is the right document, but could be checked…)

.

→ So I would say that common spaces and oaktree also count

Bikes I’m not sure, I would say doesn’t but I think it would probably be left to the appreciation of whoever is in charge.

Again, probably something to check thoroughly, but I thought I would share the info I did find out so far.